Why fake insurance policy scams go on unabated

- Rajesh Soundararajan

- Mar 09, 2021

- 3 min read

Current QR Code solutions do not do this one thing

When the Area Manager of one of the largest general insurance companies approached the police in Hyderabad, India, little did the authorities know that fake insurance rackets were widespread. The arrest of 11 people and the seizure of over 1125 fake insurance policy documents and computers, printers explains the magnitude of the operations and simplicity of such a process.

The Hindu news story

Such incidents happen despite the strict guidelines of India’s Insurance Regulatory and Development Authority (IRDAI). All insurance policies must have a QR code to ensure the authenticity of the policy.

Authenticity of a policy is one part but being able to verify a policy document easily is another. Insurance policies are of various types ranging from general insurance products such as motor vehicle insurance to life insurance etc. So in terms of transactions we have claim settlements such as motor vehicle claims or giving a policy as collateral for loan approvals and so on. Hence it is important to verify the policy before processing any such transaction and therefore the QR code’s verification method must be easily accessible, quick, seamless and trustworthy.

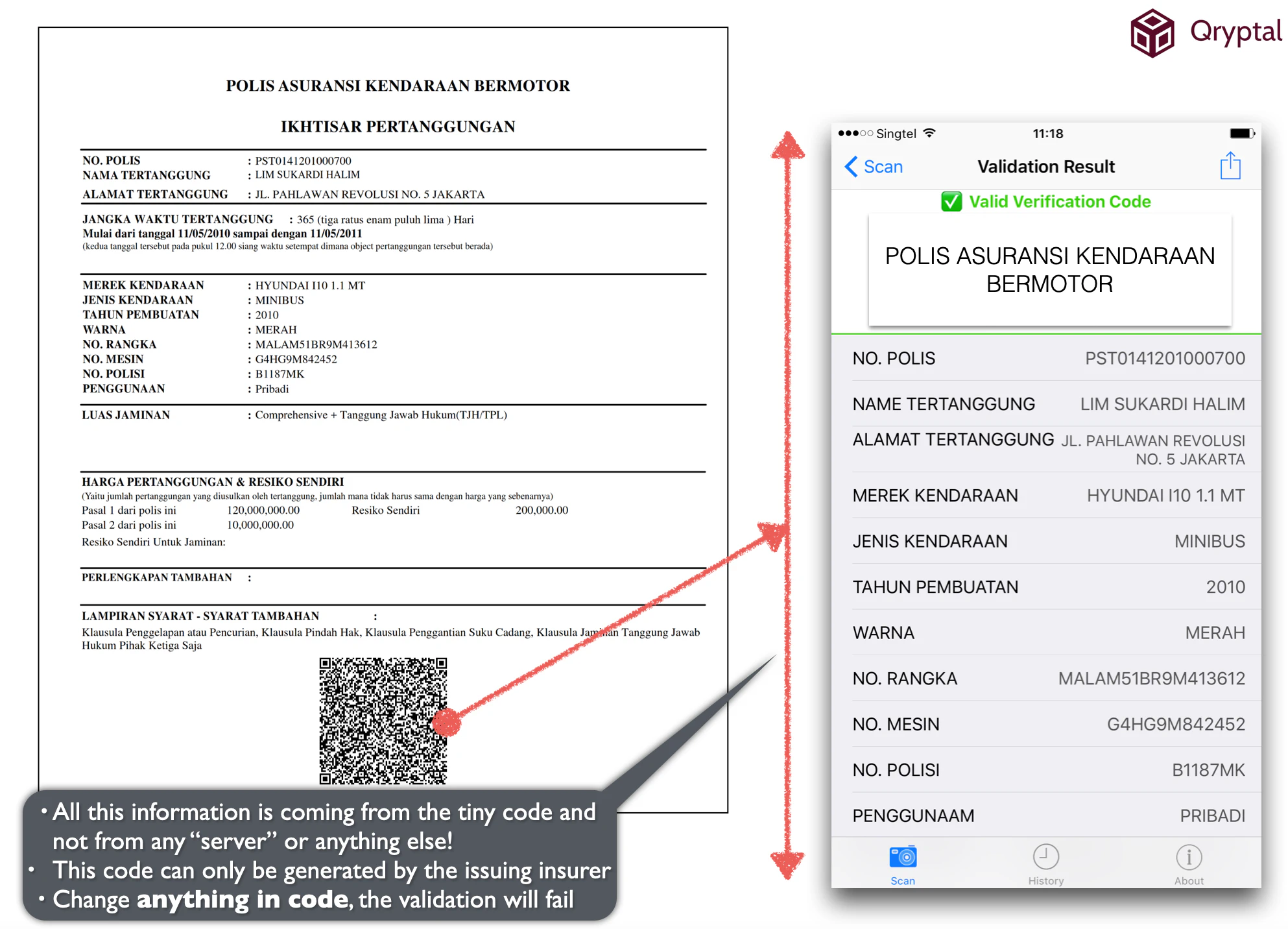

This is where Qryptal’s secure QR code helps. Qryptal Insurance QR codes come with a unique security feature making the document tamper proof while being easily verifiable and can be used in both physical-digital documents. The policy is embedded with a secure QR code that is different from other QR codes. It captures all relevant information in the form of a Secure QR code which is digitally signed by the unique private key of the issuer. This QR code is printed on the document (either physical or digital) to become an integral part of it and verified instantly without having to go back to check with the insurance company. There is no need for any URL to redirect to the insurance company server. This helps to guard against the possibility of phishing or other malicious attacks from potential hackers.

Why Secure QR

Secure QR codes capture the relevant information in a tamper proof way by digitally signing with the private key of the authorised issuer

No URL redirection, one of the biggest reasons for phishing

Makes both physical-digital documents tamper-proof and easily verifiable

Access to policy details and coverage without connecting to any database

High security and privacy with information shared only on a need-to-know basis

Easy to integrate with existing policy document production systems

A secure QR code on premium payment receipts can help in follow on actions like reimbursement and tax deductions

This is how a sample policy certificate using a secure QR code looks like:

Sample Insurance Policy with Secure QR Code

Three steps that IRDA can take for a better solution

The steps that IRDA and insurance companies need to take

Mandate that all policy certificates should be in a physical-digital format and should be standardised with a secure QR code which can be scanned by a dedicated QR app or a web validation mechanism

There should be an ability to renew or update the original certificates without the need for reissuance of certificates by updating the QR code at the back end by the authorised issuer (insurance company) itself

Make third-party verifiers aware that they can verify these documents across locations and geographies very quickly with little or no new technology intervention

Taking these steps makes it practically impossible for fraudsters to duplicate such certificates and can help in preventing such scams.

You may also like to read -

- QR Codes in the Insurance Industry

- A massive US$ 1,500,000 Insurance Policy Fraud

- Fake Medical Bills? Here is how you can stop it