Prevent forgery of Account Statements

- Rajesh Soundararajan

- Oct 25, 2018

- 3 min read

An elegant solution to address the problem of forged Account Statements

Account Statements form an integral part of any banking system. It is an important document for a bank and its account holders. Most downstream disbursements and debt financing depend on accurate Account Statements for credit-check and risk evaluation. Billions of dollars are being lent or credits approved based on these simple documents. In this era of technology, manipulations and fraudulent statements continues to play havoc with the bank’s credit approvers and debt status. Account Statements fraud can be of several types — counterfeit or forged Account Statements, using a genuine Account Statements document but altering critical details or entries fraudulently. In this article, we will mainly focus on how to address these issues.

Financial fraud involving forged Account Statements is not new. While banks and loan disbursement systems keep tightening the process and security features, the problem continues unabated. The trade-off is two-fold. One is the cost of offering high-security account statements versus benefits to the issuer. The other critical issue being the beneficiary of such a secure system would usually be a different division within the bank or in many cases may be another institution/organisation outside the issuing entity. With advancements in technology and increased stakes, even fraudsters have found clever ways of manipulation that result in significant losses for the banking industry as a whole. It has even eroded the credibility of the banks and the banking system at large. Hence the problem cannot be ignored.

One important use of bank account statements is for visa processing and it would be extremely beneficial for the embassies, consulates and intermediaries engaged in the process of visa issuance to be able to trust the documents which are being submitted. It would reduce the processing time and help the genuine applicants at the expense of the fraudsters.

https://www.khaleejtimes.com/nation/crime/dont-let-your-travel-agency-submit-fake-papers-for-visa

Typically, the Account Statements issued by banks do not have a strict regulatory framework like some of the other documents. The fraudsters hence find easy ways to forge documents that largely remain undetected, they don’t even need to use very sophisticated technology for this purpose.

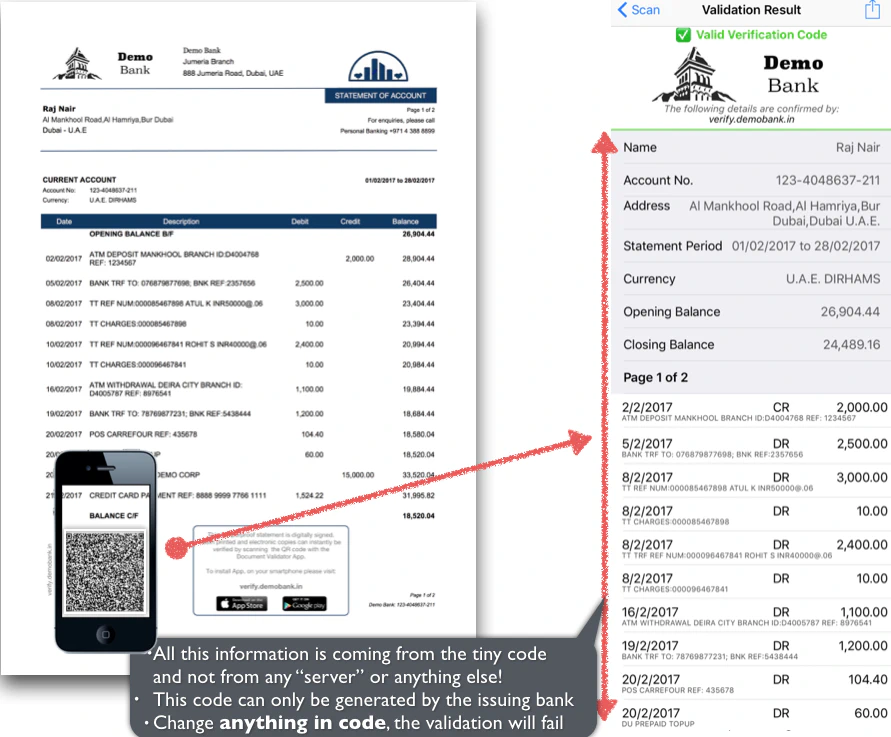

One way to avoid this is to add a QR code payment security with critical details of Account Statements stored inside a QR Code placed on the document itself. Cutting-edge technology similar to hyper ledger ensures that this high security, tamperproof code can only be created by the issuing entity, and yet can be manually or machine read across the spectrum in the ecosystem. The information inside the high-security QR Code can be cross-checked to validate the content. Most importantly the QR code is unique for ‘each’ Document and can only be generated by the issuing organization. The technology can be easily integrated with the existing infrastructure and can handle the necessary processing volumes. Qryptal Secure QR codes for financial services are privacy friendly with no dependency on cloud and zero sharing of customer sensitive information.

[Sample Account Statements document with QR code]

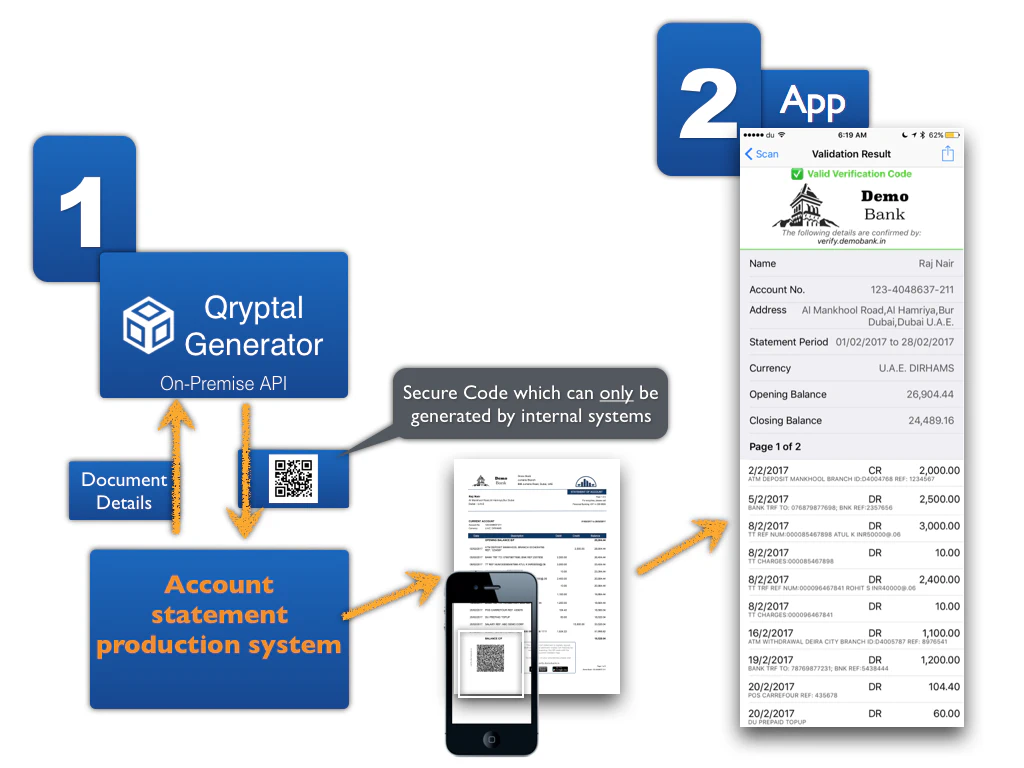

[Account Statements processing workflow]

The QR code-based system is easy to implement and does not need a significant reworking of the current workflow of Account Statements preparation and distribution.

To know more, please write to rahul.sinha@qryptal.com, who can help you with a Banking Whitepaper that can help you prevent losses in Account Statements.

Tags :

- Fintech

- Forged Document

- Account Statements Fraud

- Account Statements

- QR Code

- QR code financial services

- QR code payment method

- QR code payment system

- QR code mobile payment system

- QR code payment security

- QR code mobile payment system

- QR code digital payment

- Benefits of QR code payments

- what is QR code-based payment

- QR code payments how it works