Implementing Secure QR Codes for Banks in 2022: A Comprehensive Guide

- Rajesh Soundararajan

- Jul 12, 2022

- 3 min read

Empower Your Bank Documents with Secure QR Codes

Unlock the Potential of Secure QR Codes for Banks in 2022

Download the FREE Banking Whitepaper

In 2022, banks and their IT teams continue to seek solutions for generating documents with secure QR codes to validate the authenticity of bank-issued documents, ranging from trade finance documents and cheques to account statements.

Tackling the Core Challenge of Document Verification

At Qryptal, we have been addressing this problem for nearly a decade, serving global clients.

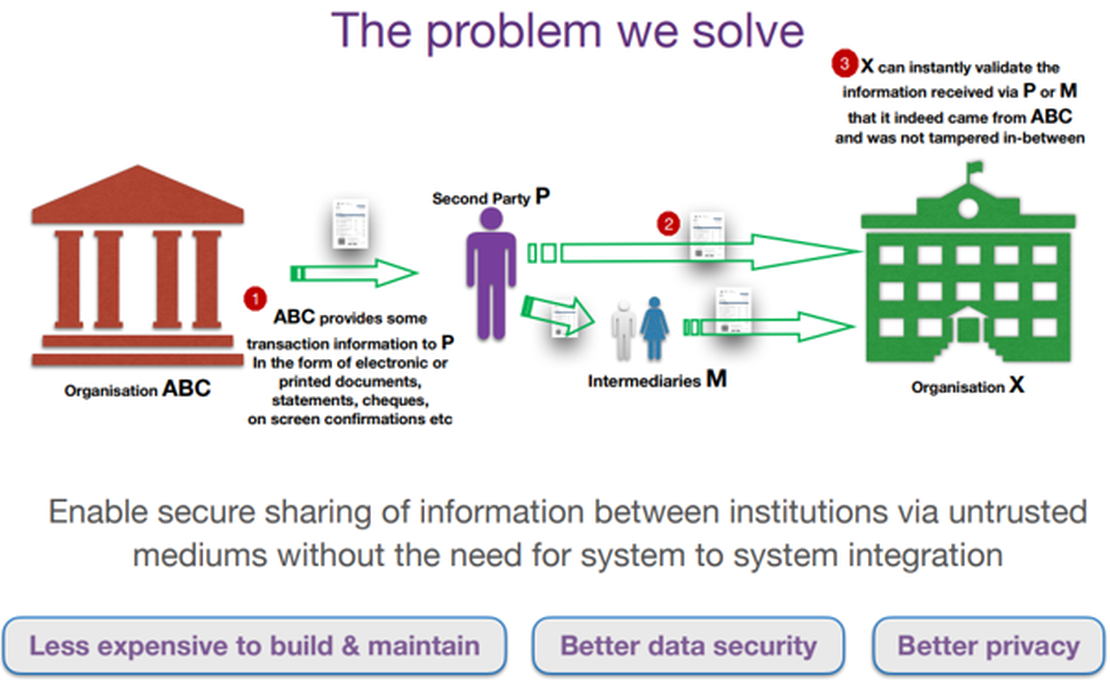

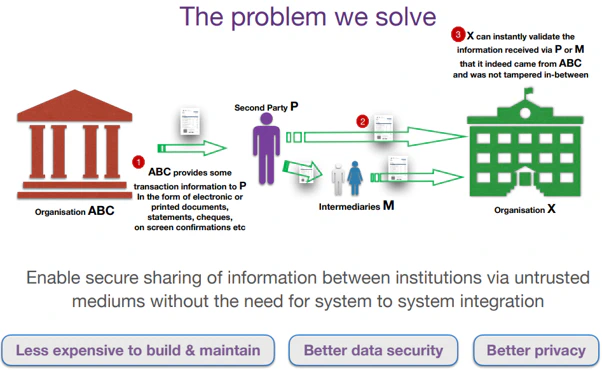

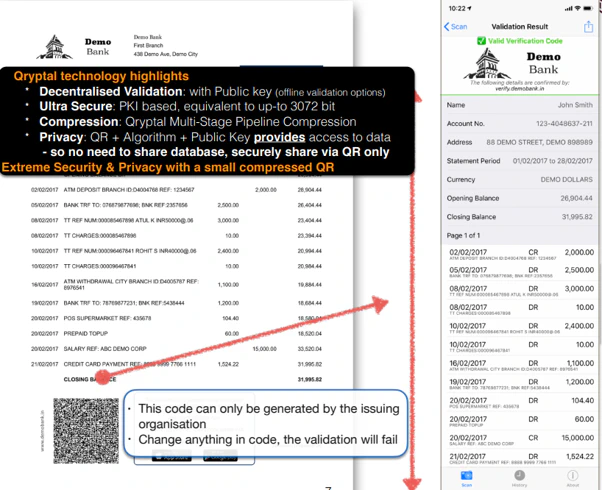

As illustrated above:

An issuing bank (organization ABC) provides transaction information to a second party (P) in the form of an electronic or printed document, such as cheques, account statements, or on-screen confirmations.

The second party (P) submits this document (in physical or digital format) directly or through intermediaries (M) to an external organization (Organization X).

The external organization, which may be a government entity, business, or institution, needs to validate the issued document (digital or physical) and take appropriate action.

Secure QR Code technology allows the external organization (X) to instantly validate the information received via an intermediary (M) or the second party (P) directly and confirm that the information came from the initiating organization (ABC). Qryptal’s framework facilitates secure information sharing between institutions via an untrusted medium without the need for complex integrated systems between organization ABC and Organization X.

Advantages of this approach include:

- Lower cost for building and maintenance

- Enhanced data security

- Improved data privacy

Download Banking Whitepaper

Revolutionizing Banking and Insurance with Use Cases in the following areas

Secure Account Statements, Transaction Advice, and Online Transaction Confirmations (to safeguard screenshots)

Fortified Cheques, Trade Documents, Bank Guarantees, and Insurance Certificates

Workflow Automation with Audit Trails: Streamlined Claims & Forms Processing

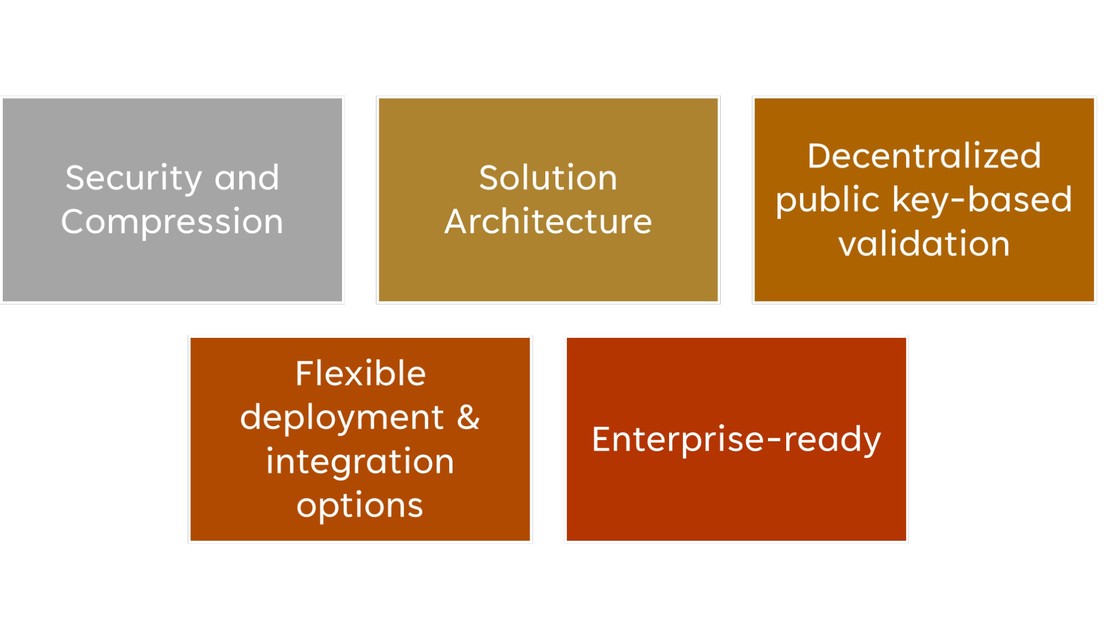

Why Choose Qryptal's Cutting-edge Solution

- Advanced QR technology for safeguarding sensitive information

- High-security and efficient compression technology

- No centralized database

- Designed for impressive scalability and modest infrastructure (millions of codes/day)

- Minimized surface area for cyber attacks

- Decentralized public key-based validation

- A variety of secure code types like PDC, EDC, and hybrid codes for diverse applications

Qryptal: The Enterprise-Ready Solution

- Proven in production use since 2016 across various markets and use cases

- Product has undergone rigorous evaluations and security audits by demanding customers

- Comprehensive services to ensure project success

- Core technology packaged in an easy-to-integrate solution with associated components

Other articles that you may also like

Everything QR – Your Ultimate Guide to the range of Secure QR Codes

5-point checklist to help draft your Secure QR based document security framework