How to Verify Insurance Policy Documents and Avoid Fake Insurance Scams

- Rahul Sinha

- May 25, 2018

- 3 min read

Beware of fake insurance policies and how to avoid Insurance scams

Beware of bogus insurance policies and related scams, is a warning we’ve all heard. But when it comes to practical life, the technicalities of insurance policies and agents are such that we tend to fall prey. And this holds true not only for the insured, but also for the Insurance Companies.

There was a recent case of an Indonesian couple, who filed and fought a legal suit against an insurance company and its top agent for a decade, recovered their damages partially with both the Insurance Company and the fraud agent held responsible.

The fraud here was a leading insurance agent of a renowned insurance company selling a phony policy. While the investor trusted and paid the premium, several other policies were brought under his name and other family members by the agent. Further, the agent also deceived the insured into surrendering earlier issued policies and giving proceeds to AIA through her. This money was siphoned off by the agent for personal benefits.

It was only 6 years later that the insured got to know about being cheated. The agent was sued for heavy damages. At the same time the company with which the agent was contracted also faced the brunt. Especially because as per the court, the life insurance industry is regulated in a manner that expected the insurance company to take responsibility for the management of the agent and keep a close check with the insured as well for it’s their interest that is paramount.

What happened in this case is called stealing of premiums and selling of phony insurance. So the agent steals the payments of the insured and pockets them for vested interests. Also, the agent can sell the bogus coverage using the name of the company, so the insured receives fake policy document that looks real, but is worthless.

These and many other frauds happen day in and out, in the insurance sector. They are not restricted to any one country but are spread across the globe.

https://www.insurancejournal.com/news/southcentral/2018/01/08/476590.htm

Smart way to avert such scams with Qryptal

Now that scamsters are getting smarter, it’s important that Insurance Companies and the insurance seekers also step up their game. Many such frauds and fake documents can simply be detected and averted by implementing a smart technology that can help ascertain the authenticity of every piece of document you see, sign or receive.

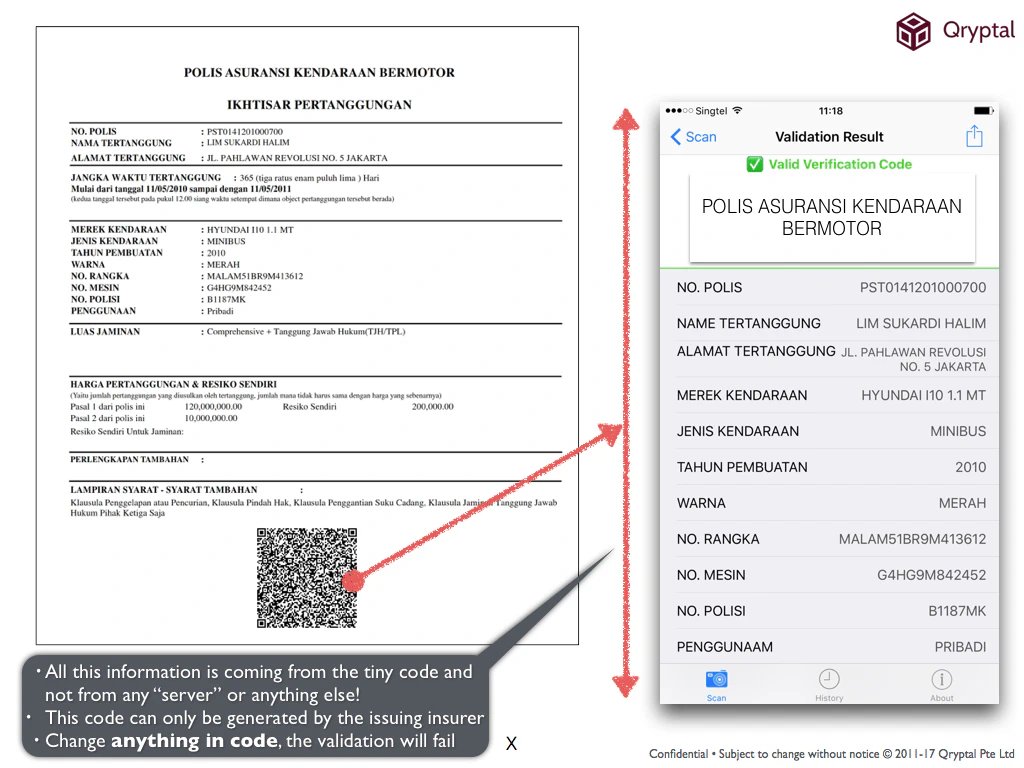

One elegant way is to use Qryptal’s secure QR code technology, which enables the documents to have unique QR codes that capture all the key details and can be scanned and verified for authenticity. These can work for all kinds of documents such as licenses and permits, receipts and invoices, certificates, IDs etc

The details once stored cannot be tampered with. Anyone can then use the Document Validator App to instantly validate the information.

Below is an illustration of use in case of an insurance policy document

Using such technology can be beneficial to both parties, insurer and insured, and bring higher trust and efficiency in the insurance industry. So say hello to Qryptal and bid adieu to insurance document frauds.