How Saudi Arabia plans to bring in transparency with e-invoices

- Rajesh Soundararajan

- Nov 21, 2021

- 5 min read

And how secure QR code makes it easy for B2C, B2B, and B2G transactions

The Zakat, Tax and Customs Authority (ZATCA) of Saudi Arabia has always been a frontrunner in adopting technology for better efficiency and transparency. On 28 May 2021, ZATCA published guidelines and standards regarding implementing an electronic invoicing (e-invoicing) system.

The first phase of e-invoicing—the “issue and storage” phase—starts on 4 December 2021 and requires taxpayers to issue and store electronic invoices and notes.

The second phase—the “integration” phase—will begin on 1 January 2023 and will require taxpayers to transmit electronic invoices and notes and share these documents with ZATCA for electronic verification and stamping.

These are guidelines published for the Phase one implementation of e-invoicing:

The controls, requirements, technical specifications, and procedural rules to implement the provisions of the e-invoicing regulations

The e-invoicing simplified guidelines

The e-invoicing phase one FAQs

Electronic invoice XML implementation standards

Electronic invoice security features implementation standards

What is expected to be done in Phase 1 ?

Updating or installing new invoicing systems

Adding QR codes to invoices

Add the buyer’s value-added tax (VAT) registration number if registered for VAT

How e-invoicing will function during phase 1 ?

The seller issues and saves the invoice through an e-invoicing system compliant with the first phase’s requirements.

The invoice must contain all the items required in a tax invoice.

The buyer receives a copy of the invoice.

In phase 2, there will be more enhanced security and technical features to build on the developments and experience of phase 1

How can organizations go about e-invoicing ?

E-invoicing or e-invoice is a procedure that aims to convert the issuing of paper invoices and credit and debit notes into an electronic process that allows the exchange and processing of invoices, credit, and debit notes in a structured electronic format between the consumer and supplier.

E-invoicing increases the efficiency of transactions by making trade more seamless, efficient and results in faster payments and reduced costs. They provide the government with more significant and real time insights into market conditions. E-invoices also protect the consumer and enable fair competition. They increase business competitiveness and align to global best practices.

E-invoicing also helps a government to detect and reduce the shadow economy. It also helps monitor the movement of goods, services, and money in (near) real-time, depending on the model they choose to implement. In turn, all this would lead to increased tax compliance and transparency, allowing data-informed decision-making.

Suppliers and governments across the world are already using e-invoices

They have stopped manual invoicing and moved to use electronic systems to bring efficiency and transparency.

While there may exist many methods, the most popular and efficient method seems to be by adding a QR code (preferably a tamper proof Secure QR code) on each of the invoices that can aid in distributed tracking and verification, including reconciliation

One of the key reasons for choosing a secure QR (vis-à-vis) more glamorous blockchain is the ability to use in phygital (physical-digital) formats, which incorporates anti-tampering features like cryptography/encryption and digital signing while retaining the flexibility to save in XML formats and have API integration with existing invoice generating systems.

Both suppliers and governments are already benefiting from e-invoicing

Consumer protection and enhanced business ecosystem with augmented fair competition through a unified process for validating and auditing transactions.

Minimize or eradicate hidden economy transactions and tax evasion by increasing invoice tracking and data retention requirements.

Enriching the consumer experience and digitizing the supplier-consumer (B2C), supplier-supplier (B2B), and supplier-government (B2G) relationship.

Increased compliance through enhanced verification of transactions.

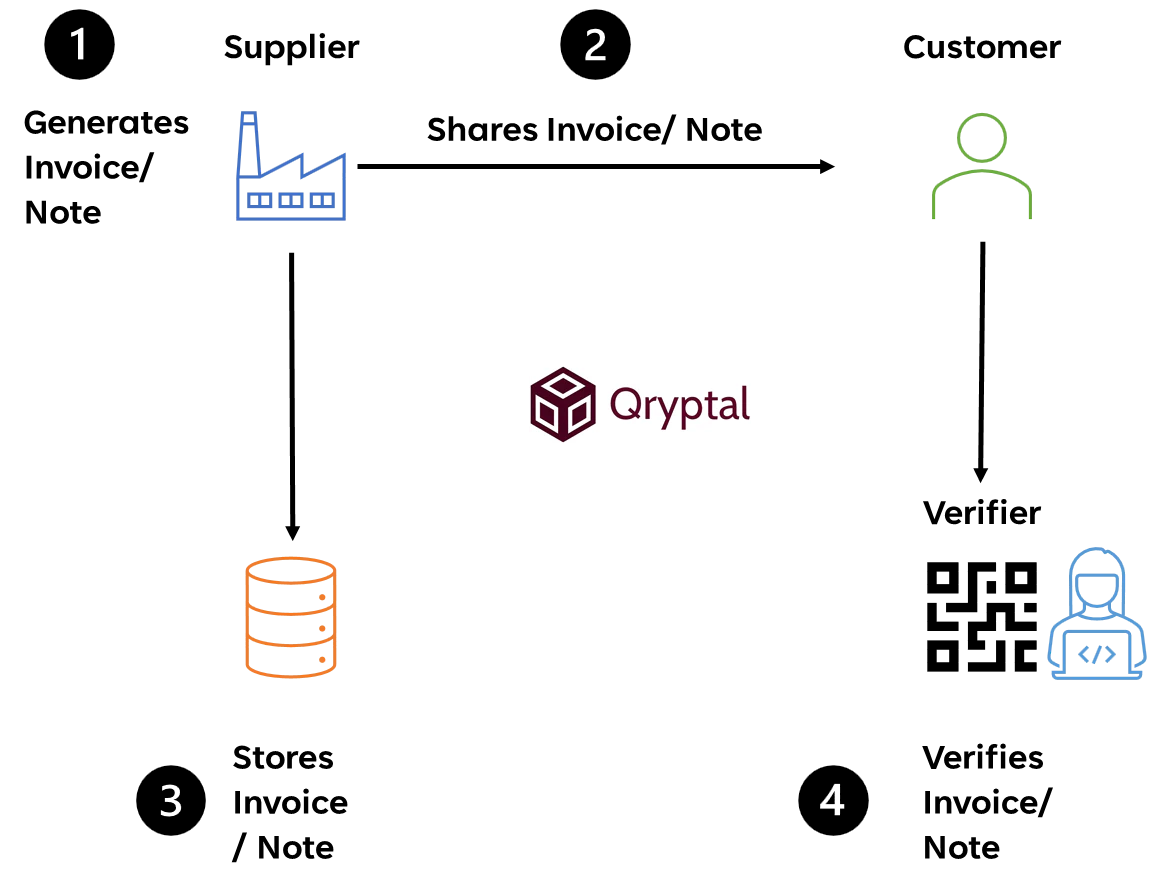

Implementation of such a project would usually involve three components

Generation or creation of e-invoices (supplier)

Verification of invoices (supplier, consumer, government)

Integration with government systems (supplier, government)

How can Qryptal help businesses and users in Saudi Arabia ?

Qryptal already has an innovative and globally proven solution that fits the requirements. We are ready with support for generating QR codes in line with the 1st phase of the Saudi e-invoice QR code specifications, which come into effect from 4th Dec 2021.

There are two ways to do this.

A. Extract relevant data from the invoice PDF and generate a QR which can then be stamped on the invoice itself. The workflow will be to upload the PDF on our system and download the invoice PDF with QR after this process.

B. API integration of Qryptal with your invoice production system generates the final invoice with QR code as per the specifications.

Both these options are available under our Cloud plans (starting with the STANDARD plan @ USD 150/month for up to 900 codes). You may refer to our pricing page for more details. The relevant data that is required to be displayed on scanning the QR code in Phase 1 are : Supplier name, the VAT registration number, total invoice value, the VAT amount and the date & time stamp of the invoice.

Qryptal can also help with the more rigorous requirements outlined for Phase 2 regarding security and integration and will be adding even more features in the QR code if required by the authorities and users based on the experience of Phase 1.

Simplified workflow

E-invoicing Workflow

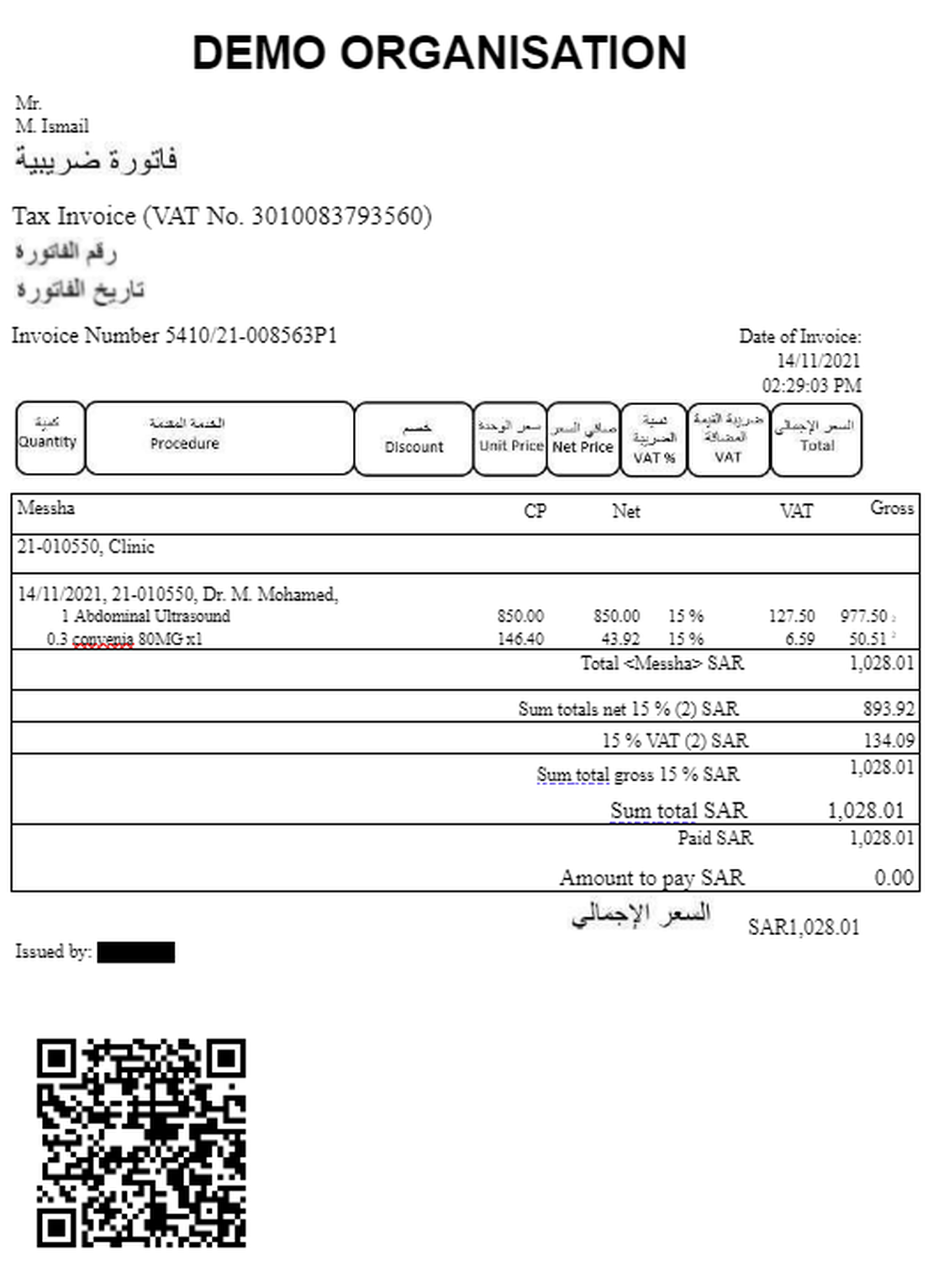

Sample invoice with QR code

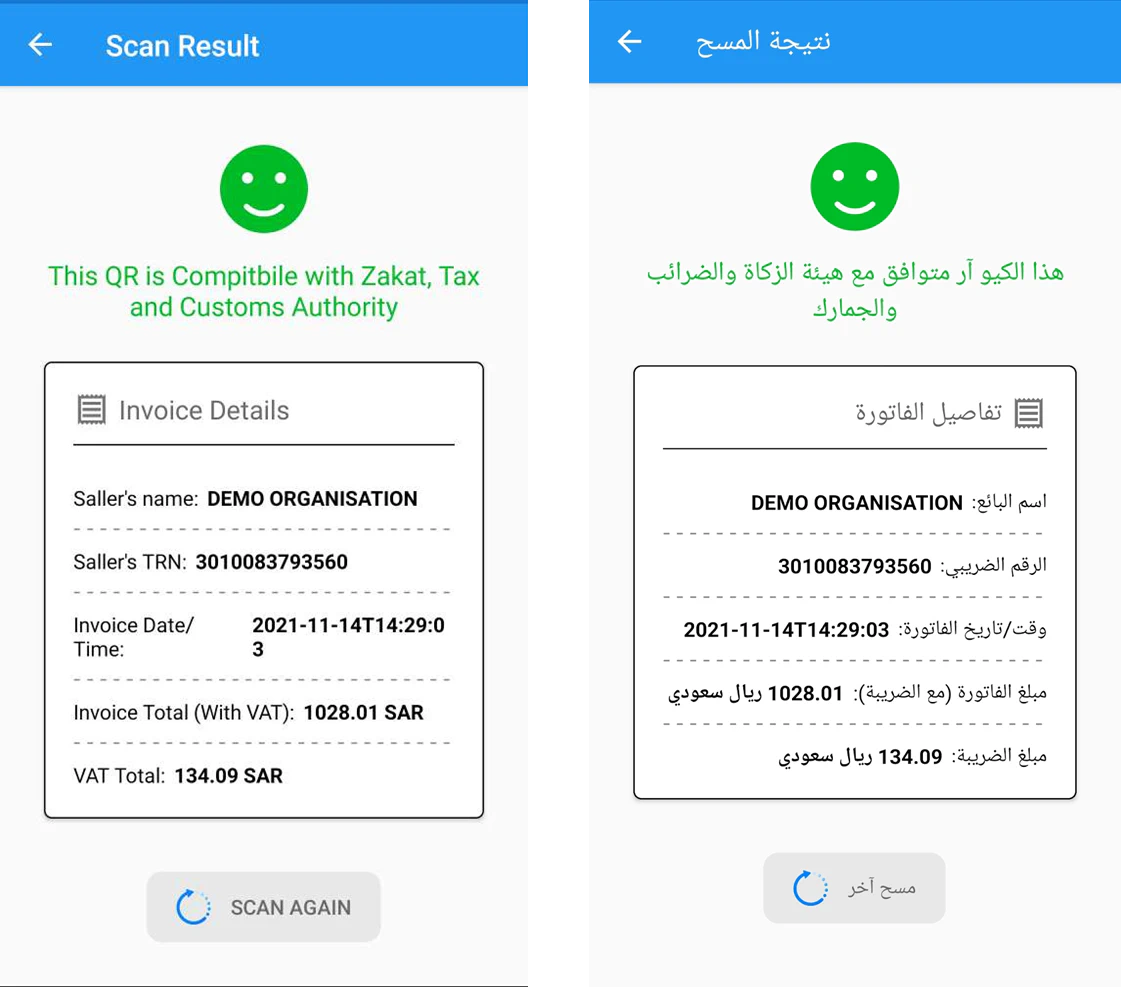

On scanning the QR code with any of the authorised or approved apps (for example : e-invoice KSA reader ) - this is what you will see.

QR code scan results

If you are an organization looking to implement The Zakat, Tax and Customs Authority (ZATCA) of Saudi Arabia’s new e-invoicing with QR code, the Qryptal team has a ready-to-go solution with special pricing on Cloud plans.

You may also like -

- COVID times have brought Fake Invoice Scams into focus like never …

- Fake Medical Bills? Here’s how you can stop it

- QR Codes for Consumer Bill Payments | QR Codes for E-Commerce ..